TARRANA II. BALANCED FUND

The Tarrana II. Balanced Fund is a global absolute return fund. The fund’s strategy is to generate absolute returns by investing in the equities, corporate credit, and alternative investments.

About II. BALANCED FUND

The Tarrana II. Balanced Fund is a global absolute return fund. The fund’s strategy is to generate absolute returns by investing in the equities, corporate credit, and alternative investments. The fund seeks to deliver positive returns during all market conditions. The portfolio manager selects equities that exhibit the features of high quality companies, especially stable profitability and predictability. The corporate credit allocation generates an attractive yield component for the fund. The alternative investment portion has low correlation during normal market conditions and high return potential during negative markets.

The Tarrana II. Balanced Fund is a sub-fund of the Tarrana Fund SICAV plc, a self-managed Professional Investor Fund regulated by the Malta Financial Services Authority. The fund offers EUR and USD share classes.

We offer an active portfolio management to achieve attractive returns while safeguarding investment against the effects of the crisis.

The strategy is to generate absolute returns by investing in the equities, corporate credit, and alternative investments.

INVESTMENT STRATEGY

The fund invests in three main components: Equity, Corporate Credit and Low Correlation Investments.

Deep knowledge of the financial markets and extensive experience investing underpin the investment strategy.

The investment strategy seeks to generate long term capital appreciation with controlled risk.

With a healthy mix of deep value positions and distressed credit opportunity, we aim to deliver a well balanced portfolio.

FUNDAMENTAL EQUITY:

40 % of the portfolio

Target capital appreciation of 15 %

CORPORATE CREDIT:

40 % of the portfolio

Target attractive yields and capital appreciation of 10 % +

ALTERNATIVE INVESTMENTS:

20 % of the portfolio

Low correlation to the other strategies with high expected returns in down markets

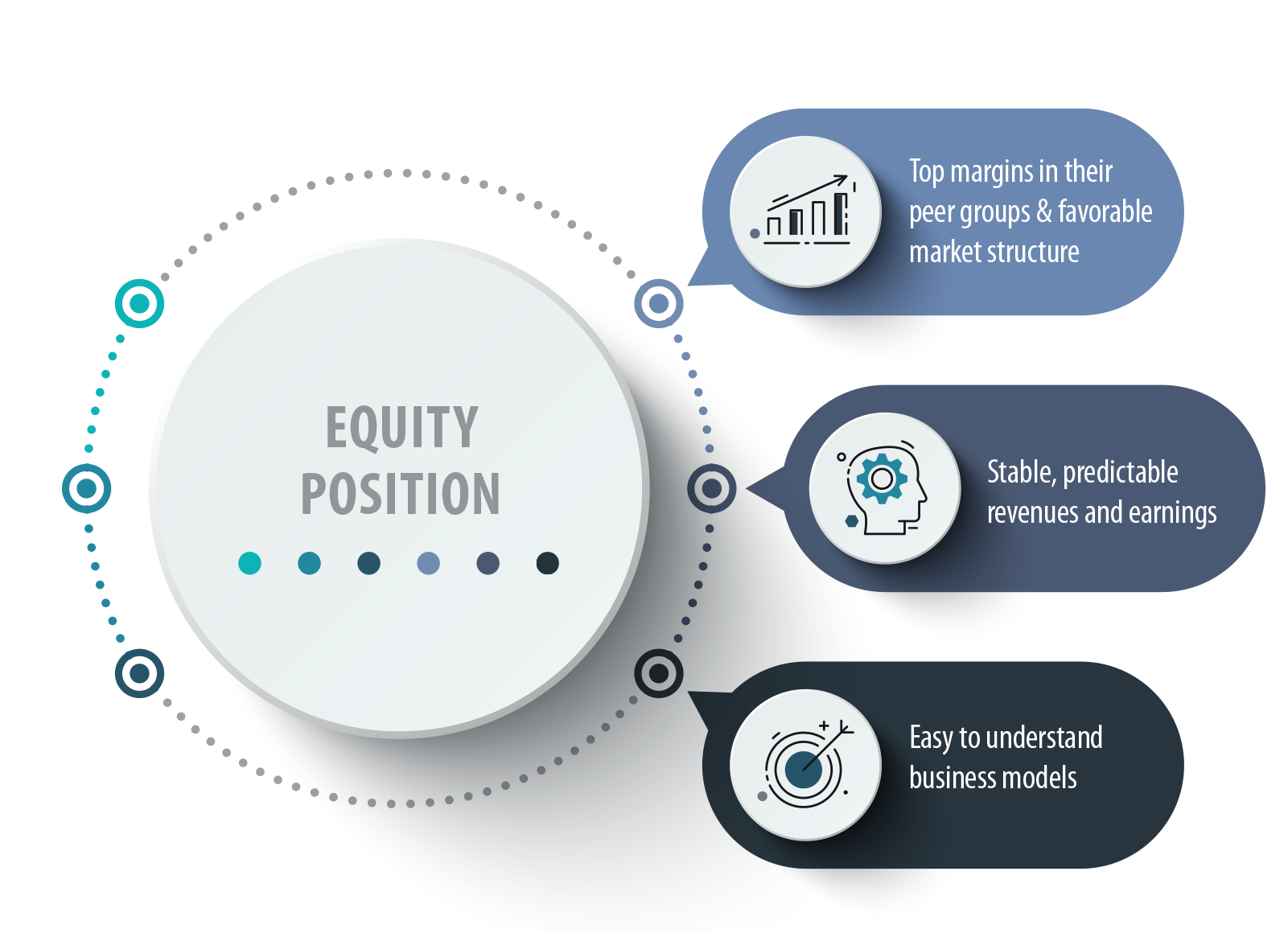

FUNDAMENTAL EQUITY

The Fundamental Equity portion of the portfolio consists of high quality businesses with shareholder beneficial policies that focus on profitability, efficiency, and growth.

We perform extensive proprietary research to identify new names and monitor current portfolio.

The strategy seeks long-term capital appreciation. The investment team continuously screens the portfolio to remove positions no longer matching

our investment criteria.

We do not base our strategy on short-term trading or market timing to deliver outperformance.

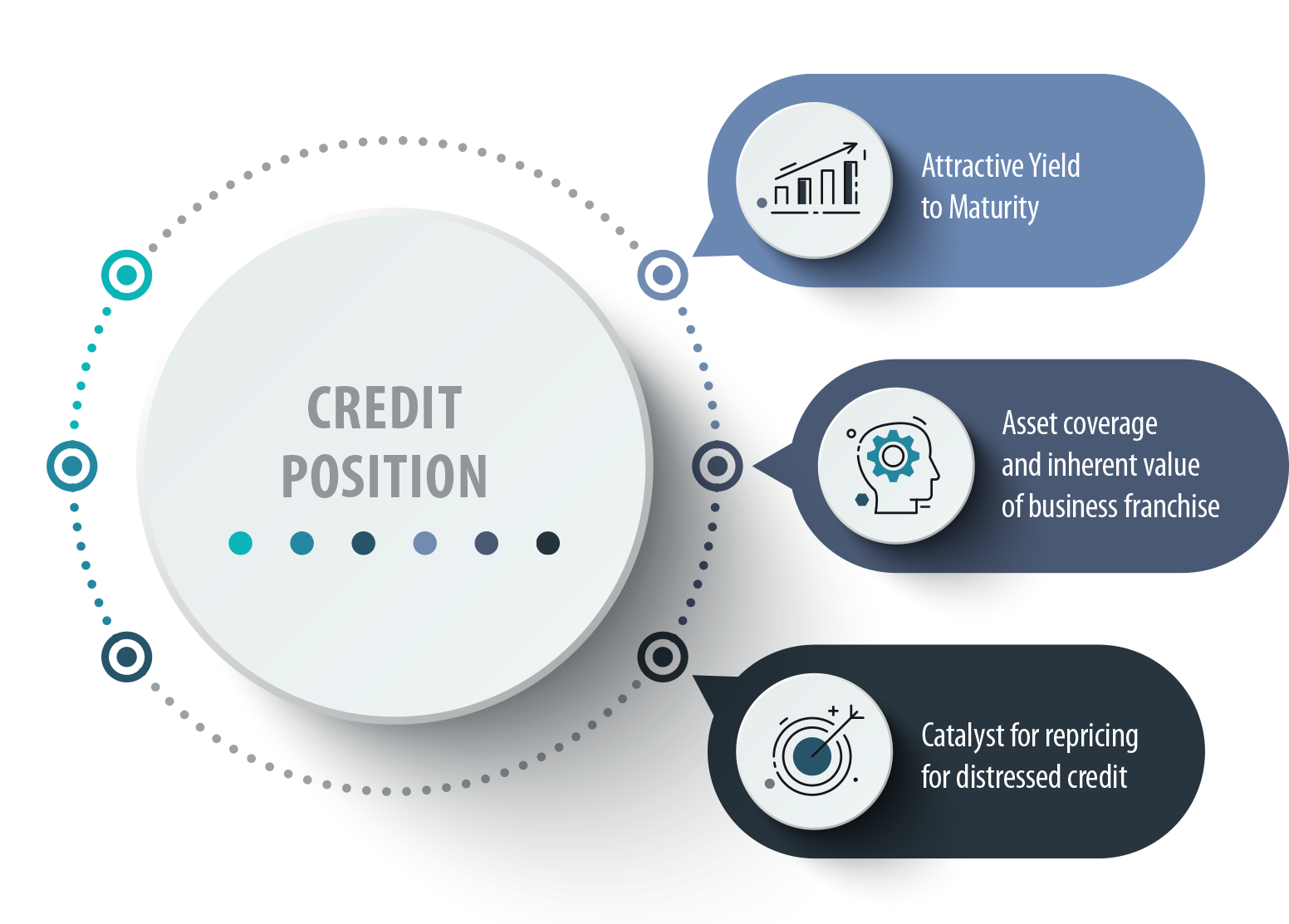

CORPORATE CREDIT

The Corporate Credit portion of the portfolio consists of two strategies, yield generation and distressed credit.

The yield generation portion seeks generate stable, long term income

for the portfolio.

The distressed credit allocation seeks to generate large capital gains by investing in the bonds of companies that are in some type of distress, which has caused the bond price to fall significantly.

The investment team performs deep research on the position, understanding the cause for the fall (including the behavior of bond holders), the future prospects for the business, and identify a catalyst for the bond to appreciate.

ALTERNATIVE INVESTMENTS

The Alternative Investments portion of the portfolio consists of investments in third party funds which are not correlated to the Fundamental Equity or the Corporate Credit portions of the portfolio.

The Alternative Investments portion seeks to protect the portfolio during down markets, while generating non correlated returns during other market conditions.

The principals of the Tarrana Fund have extensive experience in constructing portfolios of Alternative Investments and apply this expertise to create this portion of the portfolio.

TERMS AND SERVICES

Strucutre:

Professional Investor Fund Malta (de minimis AIF)

Fund Domicile:

Malta

Regulator:

Malta Financial Services Authority

Subscriptions:

Monthly

Redemptions:

Monthly with 30 days notice, 2 % early withdrawal fee

Minimum Investment:

€ 100.000

Management Fee:

2 %

Performance Fee:

depending on the type of a share class

Prime Brokers & Custodian:

Interactive Brokers, Erste Group Bank

Administrator:

Fexserv Fund Services Limited

Auditor:

Deloitte Audit Limited

Request a Call Back

Would you like to speak to one of our financial advisers over the phone? Just submit your details and we’ll be in touch shortly. You can also email us if you would prefer.

For Businesses: Do you have questions about how Broker can help your company? Send us an email and we’ll get in touch shortly, or phone 1800 234 567 between 07:30 and 19:00 Monday to Friday — we would be delighted to speak.